What is due diligence?

The corporate world is ever-changing and high-stakes, and a clear understanding of what's going on can make the difference between success and failure. Even a minor oversight can derail a multi-billion dollar deal, so it's critical to have the right information and know who you're dealing with. That's where due diligence comes in.

What is due diligence?

Due diligence has become synonymous with business risk assessment, but what does the term really mean? In short, the due diligence process involves verifying, investigating and auditing a potential transaction or investment opportunity to confirm all relevant facts and data, financial or otherwise. It is the investigative part of the Know Your Customer (KYC) process and is an important part of Anti-Money Laundering (AML) regulations.

Due diligence is critical for Mergers and Acquisitions (M&A) transactions. It allows investors to determine the financial viability of the acquisition and identify any issues with the target company's operations. By conducting a thorough investigation, decision makers can make an informed choice about the viability of the arrangement. Given that the outcome can have a significant impact on the success of the investment, companies recognize the importance of this process.

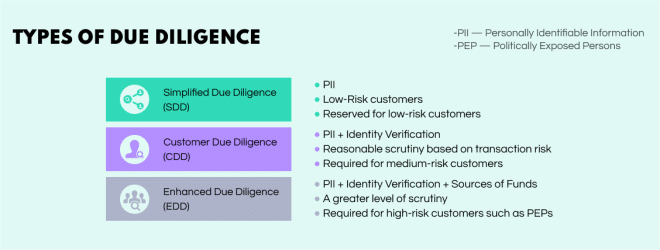

In a broad sense, we can talk about three different types of due diligence:

1. Simplified due diligence (SDD)

The lowest form of due diligence that an institution can conduct. It is applied in cases where criminal risk is slim to none and covers a superficial verification of the person’s identity.

2. Customer due diligence (CDD)

The most common form of due diligence aims to detect risk and prevent money laundering. It's actually a legal requirement, with companies facing penalties if they neglect to conduct CDD checks. Corporations failing to meet the requirements may be fined $560-2240 per violation.

3. Enhanced due diligence (EDD)

What makes EDD checks different from CDD processes is the level of scrutiny. Customer due diligence identifies the subject but does not verify their claims. Enhanced due diligence goes into much more detail to track, analyze, and consider every aspect of the subject’s financial life to minimize any potential risk. While EDD also aims to detect risk and prevent criminal wrongdoing, it’s reserved for high-risk individuals and businesses due to location, occupation, and political exposure.

銆怰esources銆戔棌The Achilles heel of AI startups: no shortage of money, but a lack of training data

【Artificial Intelligence】●Advanced tips for using ChatGPT-4

銆怤ews銆戔棌Access control giant hit by ransom attack, NATO, Alibaba, Thales and others affected

銆怰esources銆戔棌The 27 most popular AI Tools in 2023

【Web Intelligence Monitoring】●Advantages of open source intelligence

銆怤etwork Security銆戔棌9 popular malicious Chrome extensions