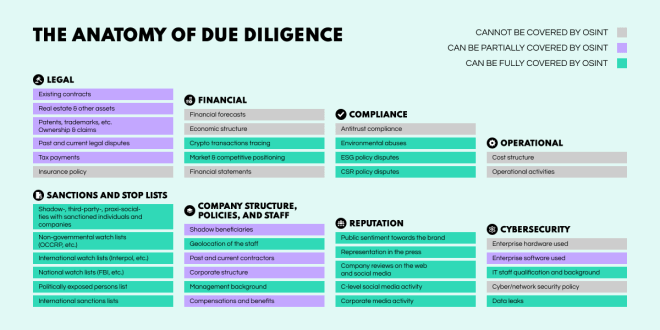

Anatomy of open source intelligence-driven due diligence

Related: What is due diligence?

It is important to understand that the role that open source intelligence plays in

due diligence is supportive, as most of the work still falls on the accounting and

legal side. However, open source intelligence can still provide value in gaining

powerful insights that can help companies make informed decisions. Here's how open

source intelligence fits into each sector:

Financial

The role of financial information in the due diligence process cannot be

underestimated. All of a company's account activity, including revenue streams,

transactions, investments or expense records, always tells a very vivid story and is

a great source for accurate risk assessment during the audit process.

Open

source intelligence tools allow analysts to quickly find public financial

information (equity or balance sheet) and revenue information (analytical reports of

previous transactions) about a company's trading history. In addition, the ability

to track cryptocurrency transactions makes it possible to identify potentially

high-risk payments and reveal a lack of transparency in the subject's accounts, thus

pointing to areas that require further investigation. As a result, the ongoing

transaction process may change in a timely manner.

Legal

Having a written record that proves a company's actions can be a lifesaver

for a successful M&A transaction. "Legal" is used as a general term to cover any

official documents and records of accounts. Collecting all contracts, real estate

records, patents, tax receipts and other required documents can support or debunk

claims made by individuals and companies.

However, any company can

accumulate a large amount of disparate paperwork that can be difficult to organize

and form into a coherent picture. Scanning and analyzing news stories about

lawsuits, sanctions lists, and non-governmental investigative reports (such as

OCCRP) is easy with open source intelligence solutions. In addition, visualization

tools allow analysts to map out how all this disparate paperwork fits together and

can help see the full picture of a company's internal processes.

Compliance

All positive or negative examples of policy compliance, such as ESG

(environmental, social, governance) or CSR (corporate social responsibility), can

play an important role in an M&A transaction. If a company does not live up to its

word, its reputation can suffer catastrophic consequences and it can risk being

fined.

Compliance-related issues are often discussed on online social

platforms, providing a valuable opportunity to examine public sentiment and uncover

data covering these topics, particularly ESG and CSR violations. Open source

intelligence tools allow for effective tracking of such discussions on social media

channels. In addition, geospatial and image analysis capabilities can provide

much-needed insight into potential ESG violations.

Company

Structure, Policy, and Staff

By describing the organization of

a company's internal processes, an organization's structure, policies and corporate

culture can often provide a broader picture of how it operates. In addition, since

many companies have embraced remote work, it is important to be able to check that

employees are where they are supposed to be and doing what they are supposed to be

doing.

Take LinkedIn, for example. This social network can provide a wealth

of data about a company's corporate structure, management, personnel changes, etc.

At the same time, users are constantly leaving indications about their geographic

location through social media and other platforms such as fitness trackers.

Open

source intelligence tools allow analysts to extract information from a variety of

sources to validate data points or inferences about individual company employees,

including where they work and their attitudes toward their jobs. They also paint a

picture of the company's internal structure and operating model and its

effectiveness.

Sanctions and Stop Lists Global sanctions

and potential ties to countries and institutions that do not align with the

company's values can pose significant problems during due diligence. While

individuals with such ties pose risks, the same is true for those on watch lists or

involved in politics. These subjects are prime targets for enhanced due diligence

because the connections between them are often numerous and complex.

By

applying knowledge derived from sanctions databases (such as the one offered by

OFAC), open source intelligence solutions can visualize the detailed network of

connections that analysts can track and examine. Very often, critical links can be

hidden, making them undetectable by ordinary search methods. But with the help of

metadata, it is possible to derive a comprehensive context of information and map

connections that are likely to be present but have been obfuscated or removed.

Reputation

With increased competition in social

media and all markets, any damage to a company's reputation can trigger a domino

effect that will eventually sink the organization. The way companies are presented

online through their management profiles, corporate media images, customer reviews

and public sentiment is critical to understanding exactly where the subject occupies

in the marketplace.

Many open source intelligence solutions are equipped

with a suite of text analytics tools that allow for in-depth sentiment analysis

around specific companies and related to many issues. NLP models mean that large

amounts of online text can be quickly analyzed and summarized to quickly understand

public attitudes toward specific companies. Thus, open source intelligence allows

one to identify sentiment in greater depth, check its veracity and whether it is

artificially generated. This allows analysts to be more accurate in their work.

Cybersecurity

Data breaches can be extremely damaging and costly for organizations. Not

only is the number of victims involved on the rise, but the average cost of a data

breach is at an all-time high. In this context, it is easy to see why cyber

resilience and data security are key issues in assessing the risk of proposed M&A

transactions.

Using open source intelligence tools, analysts can

continuously monitor the online space for security breaches and identify various

cyber vulnerabilities in a timely manner. In addition, such intelligence solutions

are able to search for red flags in the dark web. This is often critical for

assessing cyber resilience, as this is where compromised data is most often traded.

It is also where malicious tools and services, such as zero-day vulnerabilities and

DDoS-as-a-Service, are most often propagated.